social security tax limit 2022

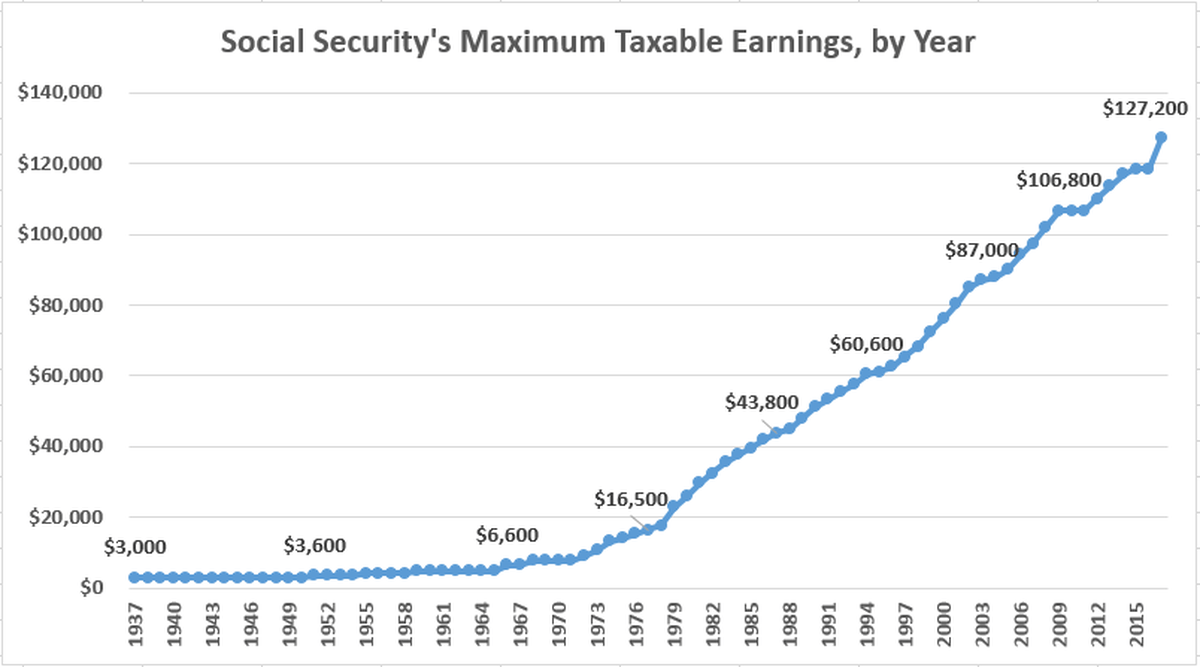

9 rows This amount is known as the maximum taxable earnings and changes each year. Biden proposed raising payroll taxes on high earners to help fund Social Security while also making the programs benefits more generous for many.

Attention High Earners Here S The Maximum Social Security Tax For 2023 The Motley Fool

How much Social Security will I get if I make 60000 a year.

. For earnings in 2022 this base is 147000. Increased Maximum Social Security Benefit. Your taxes could jump.

The largest increase was in 2023 when it was raised almost 9 from 147000 in. The federal government increased the Social Security tax limit in 10 out of the past 11 years. The wage base limit is the maximum wage thats subject to the tax for that year.

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income. If a couple is married each person would. 31 can earn up to 51960 without impacting their Social Security benefits.

The 2022 limit for joint filers is 32000. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. In 2022 for example those who will reach FRA by Dec.

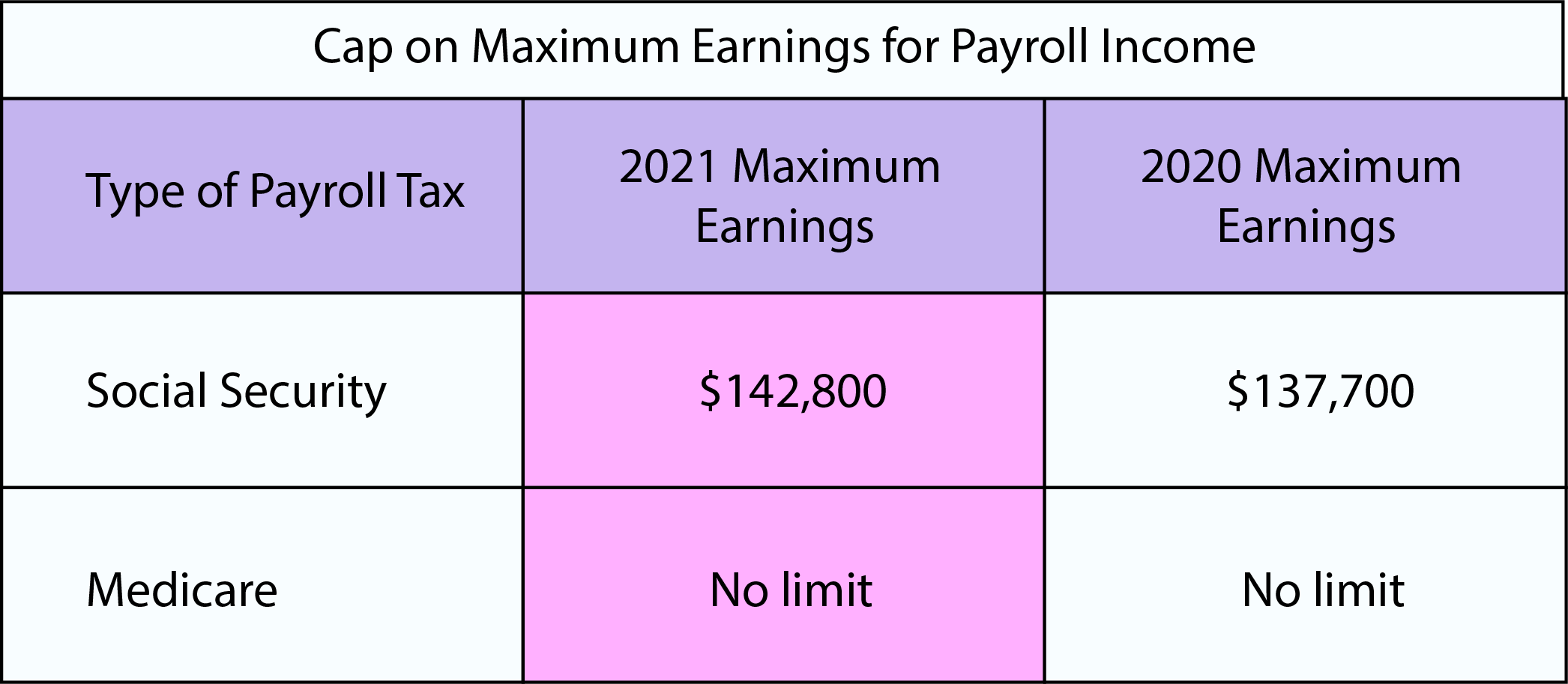

In 2023 those reaching FRA can earn up to. In 2022 that maximum is 147000. In 2022 the Social Security tax limit is 147000 up from 142800 in 2022.

It was 137700 in 2020 and. IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived. 8 rows quarter of 2020 through the third quarter of 2021 Social Security and Supplemental Security.

The OASDI tax rate for. New Bill Could Give Seniors an Extra 2400 a Year Unlike many other tax cap limits this stands as an individual limit. In the year you reach full retirement age Social Security will deduct 1 in benefits for every 3 you earn above a different limit.

Thats what you will pay if you earn 147000 or more. However the exact amount changes each year and has increased over time. For 2022 that limit is 19560.

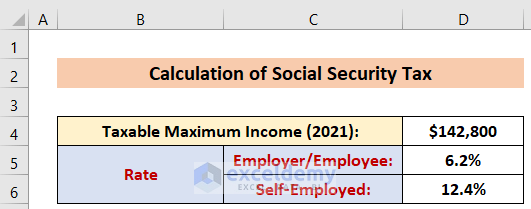

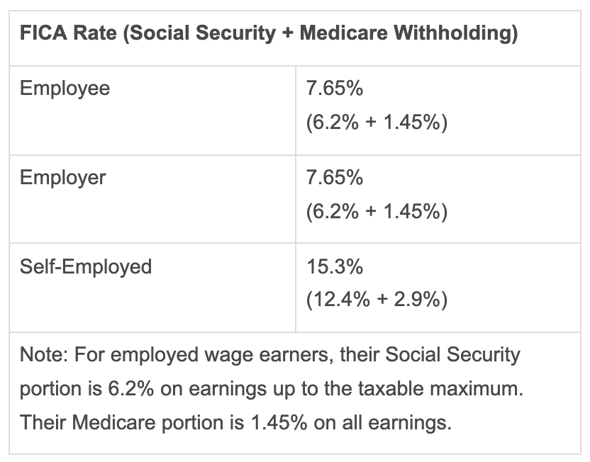

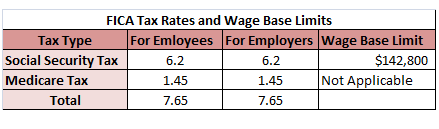

With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self. This amount is also commonly referred to as the taxable maximum. If your earned income is 160200 or greater in 2023 the maximum Social Security tax is 993240.

The most you will have to pay in Social Security taxes for 2022 will be 9114. However if youre married and file separately youll likely have to pay taxes on your Social Security income. Consider working with a financial.

Employees must pay 62 of their earnings into the Social Security fund until they reach that 147000 threshold at which point the Social. 2022 Social Security and Medicare Tax Withholding Rates and Limits For 2022 the maximum limit on earnings for withholding of Social Security old-age survivors and disability insurance. Workers who earn 60000 per year pay.

For comparison the contribution and benefit base in 2022 was 147000. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is. The trustees of the Social Security and Medicare trust funds estimate that a key Medicare trust fund will run out of money in 2028 and the main Social Security Trust Fund will.

How to Calculate Your Social Security. In the 2020 campaign Mr. For earnings in 2022 this base is 147000.

The Social Security tax limit is 147000 for 2022 up from 142800 in 2021. This means that high-earning current workers will pay Social Security taxes on more of their earnings. The 2021 tax limit is 5100 more than the 2020 taxable maximum.

For 2022 those limits. The maximum wage taxable by Social Security is 147000 in 2022. Refer to Whats New in Publication 15 for the.

We call this annual limit the contribution and benefit base.

Social Security Tax Limit Wage Base For 2022 Smartasset

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

Maximum Taxable Income Amount For Social Security Tax Fica

Social Security Benefits To Increase 8 7 In 2023 Abc News

What Is The Social Security Wage Base 2022 Taxable Limit

Social Security Calculator 2022 Update Estimate Your Benefits Smartasset

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

Payroll Tax Rates 2022 Guide Forbes Advisor

A Guide On Taking Social Security Charles Schwab

Scrap The Cap Strengthening Social Security For Future Generations Social Security Works Washington

How To Calculate Social Security Tax In Excel Exceldemy

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Diability Lawyer Social Disability Lawyer Blog Fica Taxes For Social Security Disability In 2021

2022 Minimum Social Security Benefit Smartasset

Social Security Paychecks To Increase At Highest Rate In Nearly 40 Years Fox Business

2021 Wage Base Rises For Social Security Payroll Taxes

Social Security Contributions Increased In Spain For 2022

Overview Of Fica Tax Medicare Social Security

Social Security Announces 2022 Adjustments Conway Deuth Schmiesing Pllp